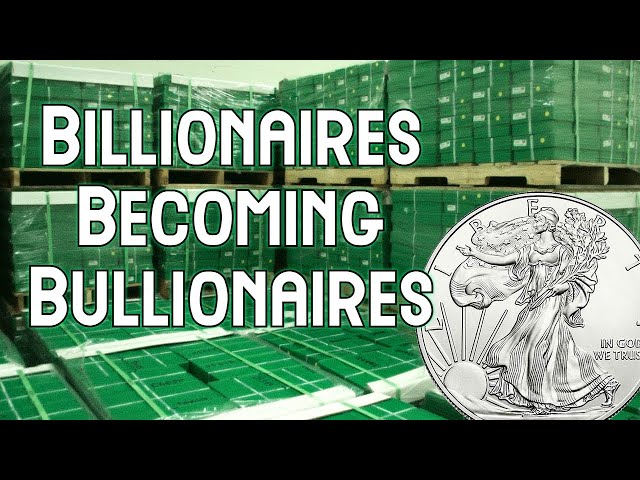

This opening footage is from a room in the US Mint's New York West Point facility.

This camera pan shows off 20 wooden pallets with 50 American Silver Eagle Mint Cases strapped, stacked, and plastic wrapped for distribution warehouse shipments by truck.

Each green case is heavy, like 40 pounds each. Nicknamed monster boxes in our industry contain 500 ounces of silver bullion coins.

So we just garnered about 500,000 ounces of American Silver Eagle coins.

This week in the physical investment grade precious metals industry, word spread that a United States domiciled billionaire has recently traded fiat US dollars for 900,000 American Silver Eagle Coins, some pre-1964 90% Silver coins, and the rest supposedly in Pre-1933 Gold coins.

A total fiat value trade of $50,000,000 USD, with approximately half allocated to silver and gold each. But all into hard US Mint legal tender bullion coinage with the claim that there will be more bullion buying from this wealthy billionaire in the coming six months.

SD Bullion’s CEO, Tyler Wall, was interviewed this past week on WallStreetSilver to help break down this industry news.

Over a year ago, we published a video about growing high net worth bullion buying on our SD Bullion channel.

It's hard to overstate how much fiat US capital the identifiable highest net worth estates in the USA control. It makes the mind reel.

And with price inflation worsening as this decade unfolds, just how much capital could come stampeding into this tiny physical bullion industry when fiat currency confidence starts crumbling.

Once high net worth estates in the USA start running to physical bullion to maintain and store value, acute physical bullion shortages will lengthen, and premiums will ultimately widen further. Most will be forced to settle for inferior risk-laden derivatives and risky mining shares.

A mixed week for the primary two monetary precious metals.

The spot silver price fell slightly over the week, losing value to gold; thus, the gold-silver ratio ended the week higher at 93.

This week's spot gold price dipped below $1,700 oz briefly but rebounded to close with some strength above the $1,725 oz bid.

In terms of where we are on a historical basis with this silver and gold spot price selloff.

Here is a look at the last over five decades of complete fiat currency era data measuring gold's 200-day moving average versus ongoing COMEX front month futures prices.

Looking at the bottom section of the graph is the key in a historic comparison context.

Gold at the moment is near -7% off from its 200-day moving average, not all that close to how hard it fell during the late 2008 global financial crisis, ticking near -20%, nor during the 2013 gold spot price meltdown and interim bear market sell-off.

In my humble opinion, the currency silver version of this over 50-year chart is more insightful.

Only three spells in this secular 21st Century bullion bull market have the fiat $USD silver spot price been beaten this far below its 200-day moving average. That was in the late 2008 Global Financial Crisis, with bank failures then commonplace, the 2013 silver spot price meltdown, and the early 2020 Covid financial market repricing when spot silver spiked down towards $12 only to rally toward $30 oz not long after.

On the fundamental front for vanishing bullion supplies, there were a few interesting silver-related news items this week, both from the other side of the world.

Indian silver demand is spiking again given the recent silver spot price selloff and discounts in fiat rupee terms. Nearly 1,000 metric tonnes or close to 32,000,000 oz of silver was imported into India last month alone, June 2022.

Most of the Indian silver bullion import flow came from the United Kingdom, so increased pressure on the London bullion float supply side, especially if Indian demand keeps going and possibly growing.

Turning finally to some news on solar panel building in China thus far in 2022.

Reuters reports a massive increase in Chinese solar installations ramping in size and scale.

While I don't think China is about to use 250 million ounces of silver in solar panels this year alone, those years and sizes for silver in solar panel use might be coming.

Recently Chinese silver solar panel market analyst Chen Lin has been making headlines regarding what his sources in China have been telling him about upcoming silver solar panel technology and cutting-edge generations in development.

China, which dominates the current solar panel industry, is working on self-cleaning automated flipping double-sided solar panels, which require more silver input per unit for higher performance and more efficient energy output.

Here is Chen Lin explaining his bullish China-increasing silver input into solar panels thesis.

That is all for this week's update.

As always to you out there, take great care of yourselves and those you love.