Economic recession fears have plunged U.S. stocks into a bear market, with the S&P 500′s decline now over 20% from it's all-time high to start January 2022.

The tech stock-driven Nasdaq is already deep in the bear market territory, trading down over 31% off its highs. These are a few names that surged during pandemic lockdowns that have been crushed this year.

Jeremy Grantham, the famed investor with a track record of identifying market bubbles, says today's bubble is worse than 2000, and he calls for US stocks to at least double their losses ahead.

We present you with a chart of the 1990s Nasdaq bubble. It continued falling in the stock bear market starting in the 2000s. And on a relative basis to today's bear market in tech stocks, we point to where the last tech bubble was after losing -31% from its peak value.

If Jeremy Grantham is correct, he is now making his case in the heart of a US stock market bull trap. The 'Return to Normal' bounce should not be too far away.

Current stock price rout looks like peanuts next to the worst periods of last 100 years

— David Ingles (@DavidInglesTV) May 19, 2022

Blue: Great Depression, WWII

Pink: Bretton Woods Collapse, Oil Crisis

White: Dot-com bubble

Orange: Global Financial Crisis

Green: Pandemic

Yellow: Inflation not transitory$SPX log chart pic.twitter.com/1KdVn6EJFA

Many are awaiting the fiat Federal Reserve to save the stock market. Still, thus far, their delay in action has not been accommodating as fundamental drivers of the consumer driven US economy are showing signs of trouble.

This week Goldman Sachs published consumer credit-fueled purchases at record high levels illustrating that US consumers are stretched and not making ends meet as consistent rising price inflationary pressures continue to eat into household budgets.

Meanwhile, gold appears poised to begin gaining in value versus the stock market bubble coming undone.

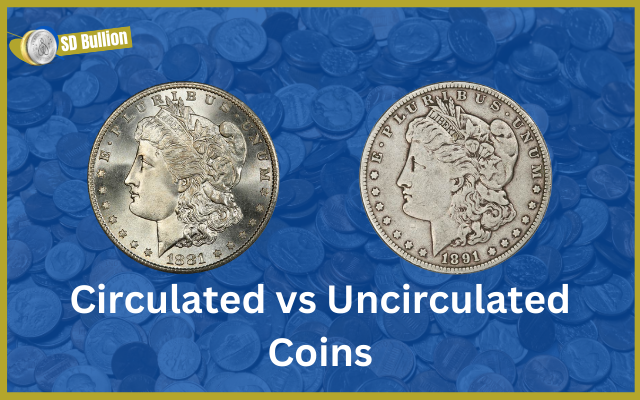

The gold and silver spot prices had a positive week of trading action.

The gold-silver ratio fell to 84 to finish this week's trading action, signifying a bit more strength in silver than gold on a percentage gain basis.

The daily silver price closed the week at just over $21.75, while the daily gold price closed at over $1845. That is slightly above gold's 200-day moving average, giving bulls some positive news that recent selling pressure may have found its bottom.

Officially reported price inflation continues hitting 40-year high levels. This past week, the United Kingdom matched its all-time low consumer confidence reading with an official inflation spike at +9% year on year.

Germany's producer price inflation hit a new record high level this week, up +33.5% year on year. The jump in energy prices nearly doubled, the most significant contributing factor in the data.

Yet I would like to remind you again.

The most significant contributing factor to increased global inflation escalation stems from the coordinated central bank policy struck in August 2019. A moment where not only Germany and the Eurozone but also the UK, Japan, and the US central banks all agreed to 'Go Direct' and bring about our current global secular price inflationary regimes.

That open conspiracy was more than a half year before the global Covid pandemic became an issue with supply chains and rolling lockdowns.

yes, this new price inflationary regime

— James Anderson (@jameshenryand) May 19, 2022

was premeditated, i.e. Aug 2019 'Go Direct'

major central bank policy shift:https://t.co/YggoP7hLHE pic.twitter.com/RAUgiwSiyn

Increasing the global fiat currency supply by over +25% is, as the August 2019 Blackrock Go Direct document (page 8) stated point-blank. Calling for coordinated inflationary actions permanently boosts the stock of fiat currency outstanding, knowing that - it will drive inflation higher. For, in the long run, the growth of the fiat currency supply drives inflation.

The Institute of International Finance reported that total global debt levels reached a new record high of $305 trillion in fiat Federal Reserve note equivalent value.

DYK

— James Anderson (@jameshenryand) May 18, 2022

in the Year 2000

total global debt was only $87 trillionhttps://t.co/VMrvj0EUTg https://t.co/vnDlHZpP8H pic.twitter.com/8oLlphr9m1

The most significant borrowing figures were mainly from Chinese and US government authorities. China added $2.5 trillion in debt. The USA added $1.5 trillion to its ballooning debt. The total global debt to GDP ratio is now at 348%.

From here to the next major financial crisis and the inevitable rewriting of the global economic rules, we suggest that investors seeking to maintain wealth consider prudent positions in bullion.

Ultimately debts that cannot be paid won't be paid in absolute and real present value terms.

And the revaluing that inevitably results favors physical bullion owners in this tumultuous decade.

That is all for this week's SD Bullion market update.

As always to you out there, take great care of yourselves and those you love.